Streamline your small business tax filing experience

Accurate bookkeeping and expert tax filing—Numinor gives you the all-in-one solution to maximize deductions and simplify tax season.

Enjoy peace of mind year-round with business tax services from Numinor Tax

Annual income tax preparation and filing, handled by experts

Year-round tax advice from an all-star team to help you boost your financial potential

Confidence you're maximizing your tax write-offs

Save time, money and stress when Numinor does your small business taxes

Ditch the tax headaches

Say goodbye to tax season stress. Our tax pros handle the red tape, and with just a bit of help from you along the way, we’ll file your taxes on time and accurately.

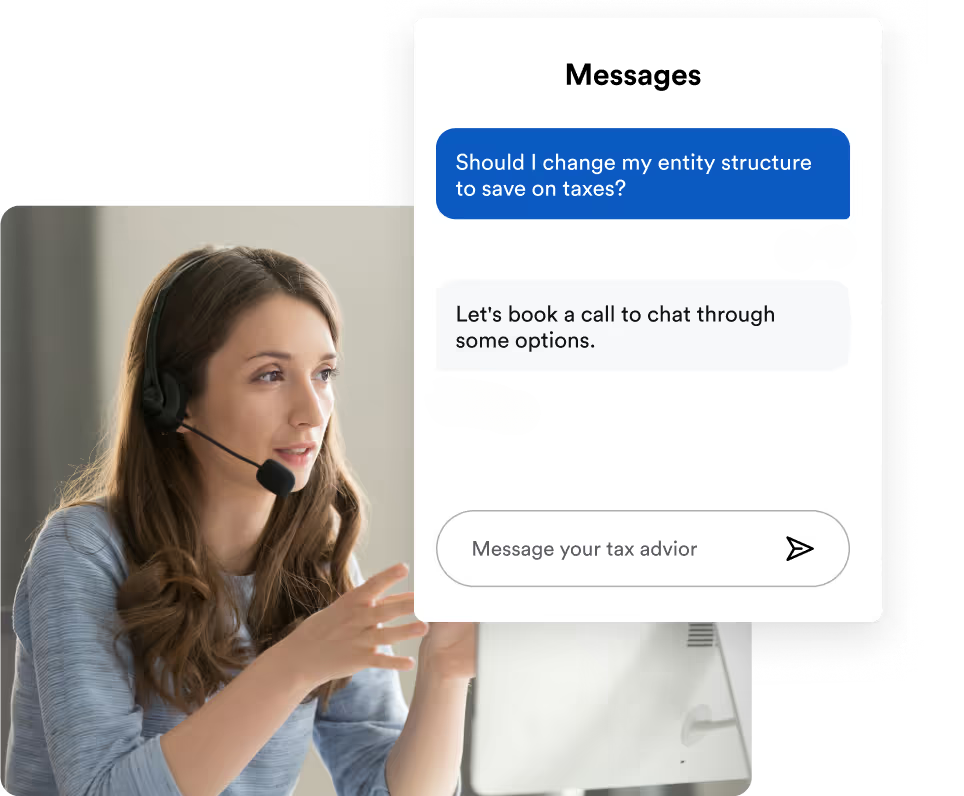

Make informed decisions with expert tax advice

Need guidance on optimizing your taxes? Our in-house Tax Advisors will help you navigate complex tax laws and minimize your tax burden.

Take advantage of all the possible income tax deductions

Maximize your tax refund by scheduling quarterly calls with your Tax Advisor. Together, you’ll review your finances to uncover deductions and credits, helping you maximize your savings.

Quarterly income tax estimates done for you

We'll keep you compliant. Schedule quarterly check-ins with your Tax Advisor to get expert help calculating your estimated quarterly tax payments.

Your all-star income tax team. Providing all the guidance you need.

Bookkeeping Team

Your Bookkeeping team completes your monthly books and prepares a year-end financial package to hand off to your Tax Advisor and Coordinator during tax season.

Tax Advisor

Our Tax Advisors are all Enrolled Agents (EA) or Certified Public Accountants (CPA) averaging 10+ years of experience. They prep and file your income taxes.

Tax Coordinator

Your Tax Coordinator supports you through the entire income tax filing process. They'll keep you on track to ensure everyone has what they need to get you filed on time.

Hear it from other small business owners who trust Numinor Tax

“Even though I have some sort of financial background, I’m not a professional. I want to make sure I’m doing everything right in the CRA’s eyes—and leave that to the pros.”

“Having Bench in my corner means I don’t have to stress about taxes. I know they’re taking care of it, and I can focus on running my business.”

Frequently Asked Questions

-

Yes! Personal federal and state income tax filings are included for sole proprietors in our Bookkeeping and Tax plan.

For corporations, and partnerships, you can add-on personal filing for 1 partner or shareholder for just $59/mo when billed annually or $69/mo when billed monthly.

-

Yep, your tax advisor is available year-round. We recommend pre-booking quarterly check-ins with them to secure your appointments because as you can imagine, their calendars fill up. Like any other accounting firm, during peak tax season months, our tax advisors are primarily focussed on preparing and filing income tax returns for their clients so you may find it harder to find appointments. If you ever have burning questions and can't find a time that works, you can always email your tax advisor and they'll get back to you within 2 business days.

-

Your tax team can help you with a wide variety of income tax-related questions! Here are some examples to get you started:

The CRA just sent me a letter, what does it mean? Do I have to pay quarterly estimates? Should I incorporate my business? Should I write off mileage or get a business vehicle? Would it be advantageous to switch to a corporation?

Your Tax Advisors are available year-round, and will answer your questions in two business days or less. Don’t have any burning questions? That’s okay, too! We’re still on hand to support you, and can give recommendations based on your unique business needs.

Join hundreds of small business owners who trust Numinor with their books.

Ready to simplify your financial management? Join Numinor today and experience the difference of having your financial team just a message away.