The Difference Between Bookkeeping and Accounting

When most people think about the difference between bookkeeping and accounting, they are hard-pressed to nail the distinction between each process. While bookkeepers and accountants share common goals, they support your business in different stages of the financial cycle.

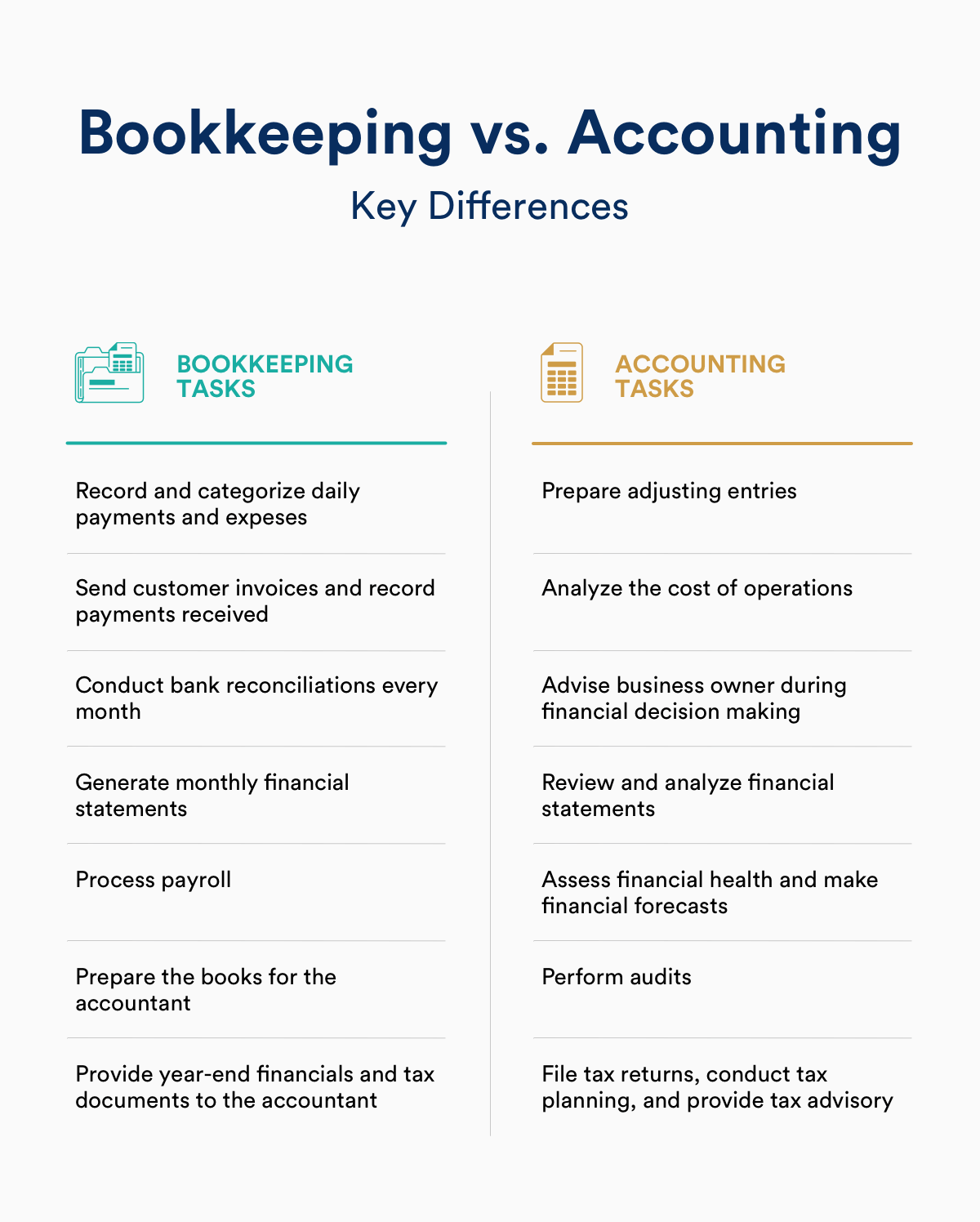

Simply put, bookkeeping is more administrative, concerned with accurately recording financial transactions. Accounting is more analytical, giving you strategic insights into your business's financial health based on bookkeeping information.

In this guide, we'll explain the functional differences between accounting and bookkeeping, as well as the differences between the roles of bookkeepers and accountants.

The function of bookkeeping, and how it fits into accounting

Bookkeeping is the process of recording daily transactions in a consistent way, and is a key component to gathering the financial information needed to run a successful business.

Bookkeeping comprises:

Recording financial transactions

Posting debits and credits

Producing invoices

Preparation of financial statements (balance sheet, cash flow statement, and income statement)

Maintaining and balancing subsidiaries, general ledgers, and historical accounts

Completing payroll

Maintaining a general ledger is one of the main components of bookkeeping. The general ledger is a basic document where a bookkeeper records the amounts from sales and expense receipts. This is referred to as posting. The more sales that are completed, the more often the ledger is posted. A ledger can be created with specialized software, a computer spreadsheet, or even a lined sheet of paper (although we wouldn’t recommend it!).

The complexity of a bookkeeping system often depends on the size of the business and the number of transactions completed daily, weekly, and monthly. All sales and purchases made by your business need to be recorded in the ledger, and certain items need supporting documents. The CRA lays out which business transactions require supporting documents on their website.

The transactions that you record in your bookkeeping are also the foundation of your accounting. Accounting practices require the pulling and analysis of financial data—in other words, everything that’s recorded in your ledger, among other financial transactions like loan disbursements or payments.

The roles: bookkeeper vs accountant

Bookkeepers and accountants sometimes do the same work, but have a different skill set. In general, a bookkeeper's role is to record transactions and keep you financially organized, while accountants provide consultation, analysis, and are more qualified to advise on tax matters.

Bookkeeper credentials

Typically, bookkeepers aren't required to have any formal credentials or licenses. To be successful in their work, bookkeepers need to be sticklers for accuracy, and knowledgeable about key financial topics. Usually, the bookkeeper's work is overseen by either an accountant or the small business owner whose books they are doing.

Accountant credentials

To qualify for the title of an accountant, generally an individual must have a bachelor's degree in accounting. For those that don't have a specific degree in accounting, finance degrees are often considered an adequate substitute.

Accountants, unlike bookkeepers, are also eligible to acquire additional professional certifications. For example, accountants with sufficient experience and education can obtain the title of Certified Public Accountant (CPA), one of the most common types of accounting designations. To become a CPA, an accountant must pass the Uniform Certified Public Accountant exam and possess experience as a professional accountant. These required credentials are a determining factor in the cost of an accountant.

Additional Resources: (coming soon, be sure to sign up for emails!)

How to Hire the Right Bookkeeper for Your Small Business

How to Find an Accountant

The bottom line

Organized financial records and properly balanced finances produced by the bookkeeper, coupled with smart financial strategy and accurate tax filing by the accountant, contribute directly to the long-term success of every business.

Some business owners learn to manage their finances on their own, while others opt to hire a professional so that they can focus on the parts of their business that they really love. Whichever option you choose, investing—whether it be time or money—into your business financials will only help your business grow.

Time is money. Don't spend it doing your own bookkeeping.

Let the pros at Numinor get your books up to tax standards and off your to-do list. Take back valuable time for the tasks that matter to your business.